Buzzfeed Readers Still Don’t See The Invisible Costs of “Free Money”

/President Biden’s plan to forgive $10K in student loans quickly became the biggest news of the last few weeks. Indeed, in what should be a sea of ugly news for Biden (Mar-a-Lago, anyone?), he’s clearly hoping debt forgiveness is his golden ticket. It might be: It’s given Biden exactly the gratified response from some wealthy, educated voters that could help to boost his approval rating. Meanwhile, for those who understand the issues involved in debt forgiveness, this move looks like just another executive power grab.

Conservative and libertarian pundits have already covered many of the important reasons why the President “forgiving” or “canceling” debt is a terrible, not to mention unconstitutional, idea. It’s an obvious handout to already relatively wealthy Biden voters. It does nothing to address — and will likely contribute to — the underlying issue of rapidly ballooning college tuition costs. It’s a bailout for people who need it the least: highly educated and capable young adults. For more on that subject, see another MC essay here.

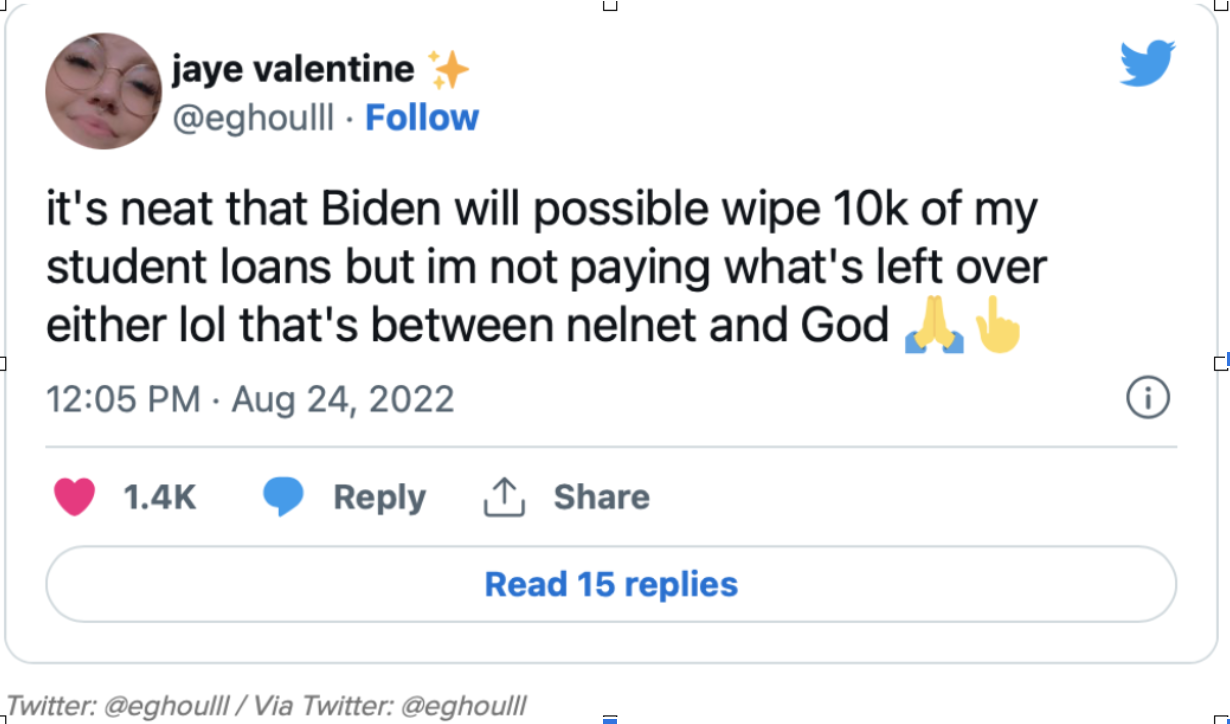

But while everything goes to hell in a handbasket, I decided to have a little fun (or make myself a little enraged) by looking up the Buzzfeed twitter roundup on the subject to see what the youths are saying. I knew going in that Buzzfeed’s roundup would be a celebration of the idea that the government can easily absorb citizen debt with no adverse consequences. I knew that would be the case despite the fact that Buzzfeed had a tweet roundup bemoaning the burden of rising inflation not even two months ago. And indeed, there’s not a single tweet in the roundup that gives any credence to the idea that “forgiving” debt might have any negative economic consequences. Among the tweeters that Buzzfeed promotes, the primary theme is: if canceling 10k of debt is good, canceling all of it would be better.

Here are a few highlights:

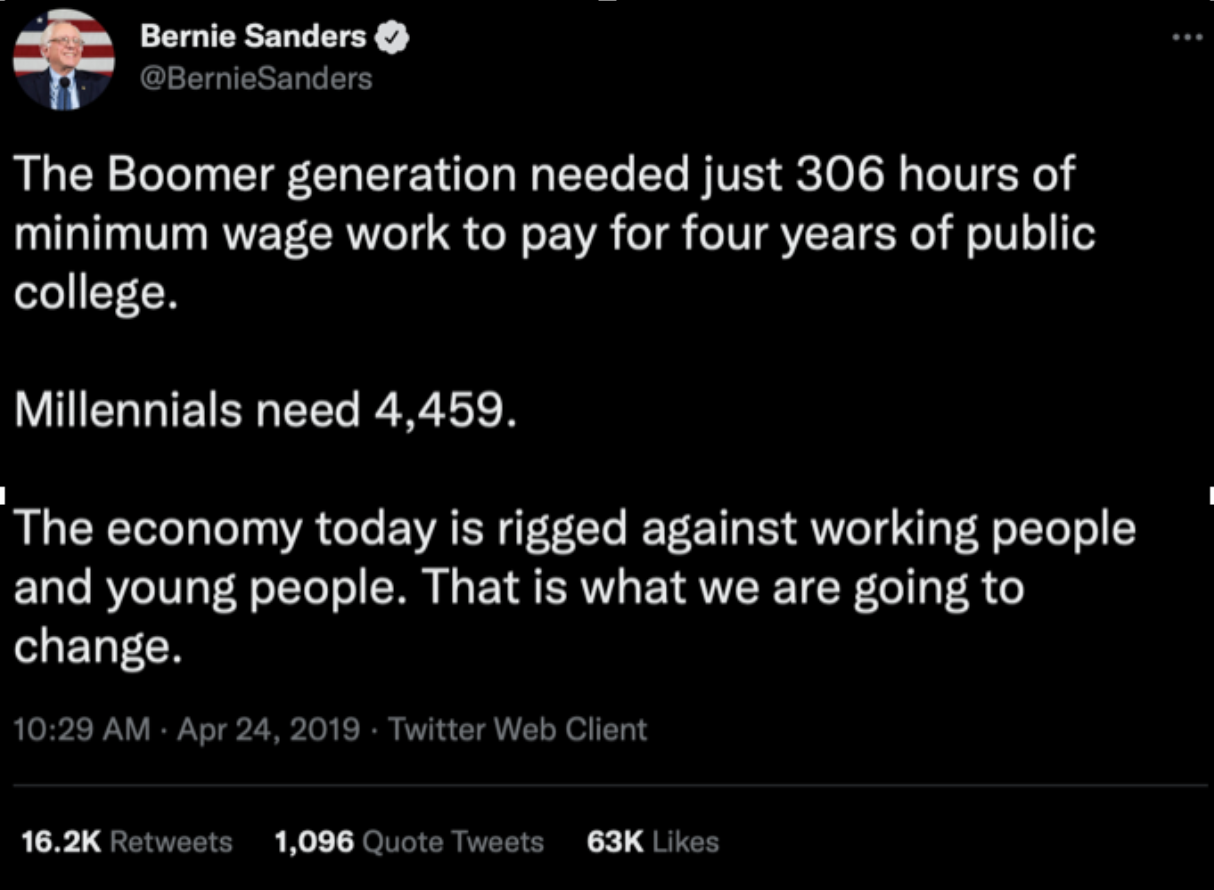

I can totally empathize with the joy someone might feel if their personal debt burden was suddenly relieved. I can even sympathize with the frustration with college costs having so rapidly outpaced other expenses. It is well known that tuition has been soaring for years, “ballooning by multiple times the rate of inflation.” A common complaint among Millennials has been that Boomers couldn’t possibly relate to the pressure of student debt because when Boomers went to college it cost more like $1000 a semester (The MC weighs in: “For my first year at Yale in 1968/69 it was $2100 for tuition, $1200 for room and board, $3300 total for the year.”). Yale tuition for the academic year 2022-23 is $62,250, $18,450 for room and board, $80,700 total.

Says Bernie Sanders:

I can agree with Bernie on this: The economy might be rigged. But the economy becomes rigged when the government chooses winners and losers. It is incredible that any person would believe that even more government subsidies and handouts could obviate the ballooning prices created by those very same subsidies and handouts. Every dollar of government handouts for no production means that much less for the producers to consume.

The Babylon Bee got right to the heart of the issue with this article: Biden to Forgive $10k in Student Loans — In Unrelated News, Nation’s Colleges Raise Tuitions by $10k. I wonder how much “free money” it will take for younger generations to put 2+2 together.