A Brief Look At The Priorities Of SVB And Credit Suisse

/Over the weekend of March 11-12, Silicon Valley Bank got taken over by federal regulators. SVB was the 16th largest bank in the U.S., with total assets of over $200 billion. Depositors were withdrawing their deposits at a rapid pace, and the bank was quickly running out of liquidity to meet the demands.

And then over this most recent weekend, it was Credit Suisse, suddenly forced by Swiss regulators into a shotgun wedding with its larger Swiss rival UBS. CS was a much older and larger player than SVB, founded in 1856, with over $500 billion of assets (down from over $800 billion as recently as 2021), and some 50,000 employees to SVB’s 8,500.

Both institutions fell victim to some combination of the usual financial risks that are endemic to the banking business. But if you had looked at the information they were putting out as recently as a month ago, you would have had to conclude that their corporate focus was entirely on the latest political fads that have little to nothing to do with the real risks facing them.

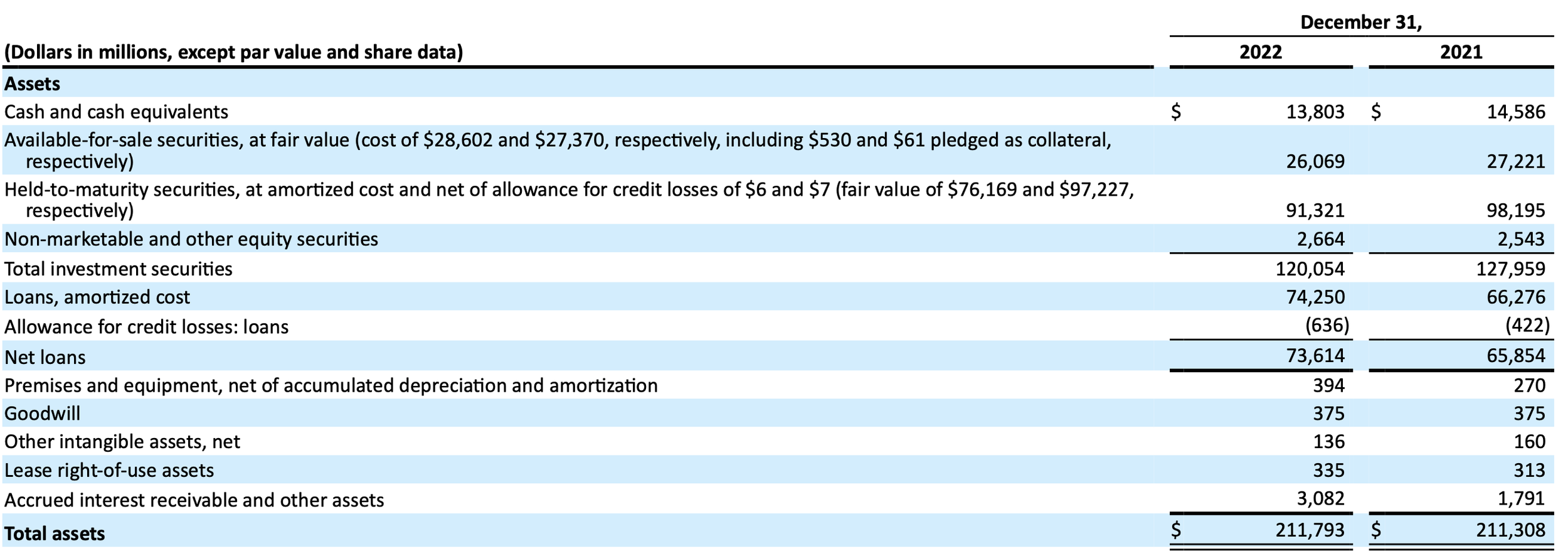

Consider first SVB. On February 24 — about two weeks before it got taken over — SVB filed its 10K for 2022 with the SEC. Nothing but good news here. Assets steady from 2021 at about $211 billion. Net income available to stockholders for 2022 of $1.509 billion, or $25.58 per share (page 96). With shareholder equity of $16.295 billion (page 95), that’s a return on investment of about 9.26% — not bad.

But is there anything to worry about? Go to the “Risk Factors” section of the Report, pages 17-37, and you will find basic boilerplate essentially copied over from year to year. There are lots and lots of risks mentioned. But how about the most fundamental risk of the banking business, which is that the assets (loans and bonds) have longer duration than the liabilities (deposits), and for that reason the value of the assets can decline rapidly in a rising interest rate environment? I can’t find anything about that one!

You don’t need to be some sophisticated economist or bank analyst to figure out SVB’s basic problem. Go to their Consolidated Balance Sheet on page 95 of the 10K. Here is the section on assets as of 12/31/22:

OK, there are $120 billion of “investment securities,” of which $26.1 billion are “available for sale” and $91.3 billion are “held to maturity.” So what has happened to the value of these in the period of rapidly-rising interest rates that the Fed has instigated in 2022 (continuing in early 2023). For the “available for sale” securities, they tell you right there — those securities were purchased for $28.6 billion and now are worth $26.1 billion, or in other words have lost about 10% of their value. For the “held to maturity” securities, they don’t tell you how much value they have lost from rising interest rates. (Accounting rules do not require declines in market value of “held to maturity” securities to be counted against GAAP income.) But if those securities have suffered similar market declines to the “available for sale” securities, then that’s another loss of over $9 billion — in other words, most of the bank’s equity. If the “held to maturity” securities have somewhat longer duration than the “available for sale” securities, it is entirely possible that all of SVB’s equity is gone.

Thus you can see right there in the 10K balance sheet that SVB was tremendously and obviously exposed to the risk of rising interest rates to the value of its assets, which were predominantly invested in long-ish term bonds. And rising interest rates were exactly what it was facing. In today’s markets, such risks can be hedged — at a cost. What was SVB doing on that front? From an op-ed by William Silber in the WSJ, March 16:

As interest rates rose over the past few years, SVB did little to hedge against its exposure to rate hikes. So when depositors came demanding cash, the bank had far less than its books showed.

In other words, SVB failed to pay attention to the single most obvious and well-known risk that it was facing as a bank. But was it paying attention to risks at all? Sure it was — it was paying attention to fake and politically trendy “risks” that aren’t real risks at all. Take, for example, climate change “risk.” Here is SVB’s Report on Climate Risks and Opportunites from its Task Force on Climate-Related Disclosures. The link is 25 or so pages, and it’s only an “excerpt” from the full Report. Hey, this is important stuff! Here’s just a tiny taste of the mumbo jumbo:

― Enterprise risk management (ERM) framework serves as our approach to identify, assess and manage risks on which climate change will likely have an impact

― Through our ERM framework, business risk teams affected by acute physical risks, such as wildfire, have been able to respond during crises to rapidly identify and manage assets at risk

― UK branch conducted preliminary, qualitative assessment of transitional and physical risks of climate change

― Monitoring emerging regulatory and industry developments globally

― Operational risks are addressed through business continuity plans

It goes on and on and on from there.

And of course, you can’t be Silicon Valley Bank without gigantic focus on “diversity, equity and inclusion.” Here is SVB’s paean to DEI, updated in January 2023. Introduction:

SVB is committed to creating a more diverse, equitable, inclusive and accessible environment within SVB, within the innovation ecosystem, and in our communities. At the heart of this commitment is our effort to foster a more inclusive culture and increase racial, ethnic and gender representation within SVB. In the broader innovation economy, we are focused on breaking down systemic barriers to entry and success, investing in opportunities that ensure more founders and investors with a range of experiences and ideas are represented in. our ecosystem.

After reading that, you would need to be nuts to put a dime of your money into this bank. Again, it goes on and on and on.

And how about Credit Suisse? Its main underlying problem looks to have been more about deals gone bad than failure to understand basic interest rate risk. But again, the diversion of its focus as an institution onto climate change and DEI issues is truly extraordinary. Here is the CS Climate Change Report. Introduction:

We address the challenge of climate change at various levels. We take into account environmental and climate impacts in our risk management and product development. Our operations have been greenhouse gas neutral since 2010. We also engage with stakeholders to gain insights that can help us develop sustainable business practices.

And Diversity, Equity and Inclusion merits a vast section of CS’s website.

Banking is an inherently very risky business. It takes a high degree of competence and focus to manage those risks. If you see a bank veering off into focus on “climate change” risk and Diversity, Equity and Inclusion, you know immediately that they have lost their way. The same applies to many other businesses as well.